legrandrozetki.ru Tools

Tools

How To Track The Bond Market

Macroeconomic analysis: Portfolio managers use top-down analysis to find bonds that may rise in price due to economic conditions, a favorable interest rate. Our experts share how to balance day-of market news and events with long-term investment trends. Learn about exciting innovations in the environmental. Search on TRACE symbol or CUSIP to find a security and review details including real-time trade history. You must agree to the Fixed Income User Agreement. Use a broker who specializes in bonds. If you're purchasing individual bonds, choose a firm that knows the bond market. Use FINRA BrokerCheck to help find. As of August , ICMA estimates that the overall size of the global bond markets in terms of USD equivalent notional outstanding, is approximately $tn. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Locate an Investor Center by ZIP Code. Please enter a. Market value-weighted, the index seeks to measure the performance of U.S. corporate debt issued by constituents in the iconic S&P Documents. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. A bonds overview presented by Barron's. View current bond prices and bond rates for deeper insight into the bond market for better bond investing. Macroeconomic analysis: Portfolio managers use top-down analysis to find bonds that may rise in price due to economic conditions, a favorable interest rate. Our experts share how to balance day-of market news and events with long-term investment trends. Learn about exciting innovations in the environmental. Search on TRACE symbol or CUSIP to find a security and review details including real-time trade history. You must agree to the Fixed Income User Agreement. Use a broker who specializes in bonds. If you're purchasing individual bonds, choose a firm that knows the bond market. Use FINRA BrokerCheck to help find. As of August , ICMA estimates that the overall size of the global bond markets in terms of USD equivalent notional outstanding, is approximately $tn. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Locate an Investor Center by ZIP Code. Please enter a. Market value-weighted, the index seeks to measure the performance of U.S. corporate debt issued by constituents in the iconic S&P Documents. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. A bonds overview presented by Barron's. View current bond prices and bond rates for deeper insight into the bond market for better bond investing.

The most important aspects are the bond's price, its interest rate and yield, its date to maturity, and its redemption features. Analyzing these key components. Not all bond funds or ETFs are actively managed. Investors who seek bond exposure in a fund can also choose among ETFs and index funds that track bond market. Overnight trading hours available for US Treasuries, European Government Bonds (EGBs) and UK Gilts · Trade directly with other IBKR clients · Rated Best Online. However, interest rates in financial markets change all the time and, as a result, new bonds that are issued will offer different interest payments to investors. Investors can: check a day's trading activity on a given bond. sort trades done by retail and/or institutional clients. Our index uses weekly metrics to construct an aggregate index of corporate bond market conditions for both the primary and the secondary markets. We update the. Our experts share how to balance day-of market news and events with long-term investment trends. Learn about exciting innovations in the environmental. Closing index values, return on investment and yields paid to investors compared with week highs and lows for different types of bonds. See the overview of the world bond market: track countries' government bonds, including US Treasury bonds, read important news, and prepare to invest. The Bond API of Instrument Pricing Analytics enables traders, portfolio managers and risk officers in the fixed income market to analyze government and. The BondbloX App helps you track bond prices, manage your bond portfolio digitally, get bond market news, select the right bonds using bond screeners and more. Benchmarks exist to track bond yields and serve as a relative measure of price performance. Bond Market Classifications. The bond market consists of a great. Bond markets tend not to see big swings in value like stock markets do. But they do fluctuate, thanks mostly to changes in interest rates. 7 minute read. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates The Bond Market Rally Rides on. Orders in the NYSE Bonds market are executed on a strict price / time priority. All participants have access to a fair, open environment that displays live. Closing index values, return on investment and yields paid to investors compared with week highs and lows for different types of bonds. The NYSE conducts two daily bond auctions – an Opening Bond Auction at am ET and a Core Bond Auction at am ET. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most. You can find fixed income security and trade information, including real-time data on bonds and other fixed income products as well as aggregate data on fixed. Bonds are debt securities that entitle the holder to receive interest payments. Although many stock investors may ignore the bond market, fixed income markets.

Fast Ways To Make Money For 12 Year Olds

1. A lemonade stand It may be old-fashioned, but kids can bring in good money by selling cups of America's favorite hot-weather drink. Blogger or Vlogger. I want to begin by stating that if you kid wants to make some fast cash, this is definitely not the route to go! As a professional blogger. Intellectual or creative work such as tutoring, singing, playing an instrument, and teaching are options for kids to make money. Pursuing a job through. Kids may know all sorts about using a smartphone or computer, so one way of making money as a kid is to pass on that knowledge to adults. It could even be. #11 Lawn Care Service This is another good incentive for kids to make money. A lawn care service can earn you money if you do a good job, you get paid well. Teens, kids, and adults alike enjoy playing video games—and as it turns out, that favorite hobby can also earn teenagers extra money. Scrambly. Some teens would. And then there are the more unique and creative jobs like selling homemade crafts or growing your own vegetables. Just remember to stash some of that cash away. The internet and online space can be extremely valuable for a child to make money quickly. It can also be a scary place and one that should be monitored closely. 3. Watering Plants Another good way for a younger child to make money is to water plants for older neighbors or for people who go out of town. While they may. 1. A lemonade stand It may be old-fashioned, but kids can bring in good money by selling cups of America's favorite hot-weather drink. Blogger or Vlogger. I want to begin by stating that if you kid wants to make some fast cash, this is definitely not the route to go! As a professional blogger. Intellectual or creative work such as tutoring, singing, playing an instrument, and teaching are options for kids to make money. Pursuing a job through. Kids may know all sorts about using a smartphone or computer, so one way of making money as a kid is to pass on that knowledge to adults. It could even be. #11 Lawn Care Service This is another good incentive for kids to make money. A lawn care service can earn you money if you do a good job, you get paid well. Teens, kids, and adults alike enjoy playing video games—and as it turns out, that favorite hobby can also earn teenagers extra money. Scrambly. Some teens would. And then there are the more unique and creative jobs like selling homemade crafts or growing your own vegetables. Just remember to stash some of that cash away. The internet and online space can be extremely valuable for a child to make money quickly. It can also be a scary place and one that should be monitored closely. 3. Watering Plants Another good way for a younger child to make money is to water plants for older neighbors or for people who go out of town. While they may.

Best Jobs For Young Teens That Pay · McKenzie Johnson · Summer Jobs For Teens ; How to Make Money as a 12 Year Old · MIKA · Ways To Earn Money At 13 ; 33 Best Ways. If so, you could sell your creations online. Platforms like Etsy are filled with handmade goods created by kids and teenagers. Custom woven jewelry and hand-. Different ways to make money offline as a year-old include creating printables, selling beverages, painting, being a golf caddy, and delivering newspapers. The digital space means kids can make money in a range of ways. These are some of the more popular routes they take. A little persistence and creativity can lead your year-old to a number of money-making opportunities. Fiverr is a popular freelancing platform that allows you to make money by offering many different services (see a few examples below). Most jobs are for digital. Online Surveys for Kids Online surveys are an easy and fun way to make money online as a kid. There are a number of survey sites that offer rewards in. Part 1: Opportunities for Younger Kids · Chores and Odd Jobs · Babysitting, Dog Walking, and Pet Sitting · Selling Personal Items Online or In-Person · Lemonade. WAYS FOR YOUNGER KIDS TO MAKE MONEY · LEMONADE OR DRINK STAND · RESELLING PERSONAL ITEMS · DOG BRUSHING/GROOMING · PET WALKING/SITTING. Kids may know all sorts about using a smartphone or computer, so one way of making money as a kid is to pass on that knowledge to adults. It could even be. Create friendship bracelets: Many kids collect friendship bracelets and love to find unique designs they can't make for themselves. Design jewelry: Jewelry can. If your family owns a business, this is a great way for kids to earn money and learn about running a company while also earning money. Children can do many. Here are 16 easy ways for kids to make money. Each takes a little creativity and good old fashioned work. Affiliate marketing can be one of the best online jobs to make money as a teen because it requires no initial investment and you don't need any experience or a. There are a variety of things children of different ages can do quickly and easily without special tools or materials. Create friendship bracelets: Many kids collect friendship bracelets and love to find unique designs they can't make for themselves. Design jewelry: Jewelry can. Another way through which your kids can easily earn an income is by selling digital goods online. They can easily create an online course or an e-book on the. Another way through which your kids can easily earn an income is by selling digital goods online. They can easily create an online course or an e-book on the. My 9 year old wants to earn some money, but I think children should do chores because they belong to a family. What are other ways kids earn money? Survey Junkie is the most reputable online survey company and an easy way to make some extra money in your free time. Kids Can Make Money Online. So.

Cd Return On Investment

Annual percentage yield (APY) This is the effective annual interest rate earned for this CD. A CD's APY depends on the frequency of compounding and the interest. Interest conscious individuals seeking maximum returns may benefit from special options that include a unique Climbing Rate CD, featuring an interest rate. CDs offer a fixed rate of return that guarantees you earnings when the term is over. And right now, CD rates are high—over 4% and 5% in many cases—so you can. With a minimum balance of $, a CD is among the most secure investment vehicles with a higher return than traditional savings. CDs allows you to earn a high interest rate for leaving your funds untouched for a chosen period of time. See our competitive rates and open an account. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Maries County Bank . Or, you may want to use a CD as an emergency fund that earns a guaranteed return. One of the downsides of CDs is that your money is locked into the investment. More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length that works best for you. Another factor contributing to today's CD rates? An inverted yield curve. Typically, longer-term interest rates are higher than shorter-term, but the opposite. Annual percentage yield (APY) This is the effective annual interest rate earned for this CD. A CD's APY depends on the frequency of compounding and the interest. Interest conscious individuals seeking maximum returns may benefit from special options that include a unique Climbing Rate CD, featuring an interest rate. CDs offer a fixed rate of return that guarantees you earnings when the term is over. And right now, CD rates are high—over 4% and 5% in many cases—so you can. With a minimum balance of $, a CD is among the most secure investment vehicles with a higher return than traditional savings. CDs allows you to earn a high interest rate for leaving your funds untouched for a chosen period of time. See our competitive rates and open an account. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Maries County Bank . Or, you may want to use a CD as an emergency fund that earns a guaranteed return. One of the downsides of CDs is that your money is locked into the investment. More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length that works best for you. Another factor contributing to today's CD rates? An inverted yield curve. Typically, longer-term interest rates are higher than shorter-term, but the opposite.

CDs are bank deposits that offer an interest rate for a certain period of time. The issuing bank agrees to return your money on a specific date. Learn more. High-yield CDs: Similar to a high-yield savings account, a high-yield CD offers a substantially higher rate of interest than regular CDs. The catch is that you. return on your investment. There are different ways that financial institutions can calculate interest for loans and investments, like savings accounts and. Visit a Frost financial center for CDs of $, and over, backed by the security of Frost. *Annual Percentage Yield effective as of 09/10/ The interest. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively. The interest and APY earned amount is based on the advertised APY, and assumes that for the entire investment period, that the principal and interest remain on. Certificates of deposit (CDs) secure your investment at a fixed interest rate in a variety of terms as short as 30 days. CD values are subject to interest rate risk such that when interest rates rise, the prices of CDs can decrease. If CDs are sold prior to maturity, the investor. If you're trying to decide on a place to put your money, and don't anticipate needing access to your funds during the duration of a CD term, a CD may be a good. For other CDs, you can receive interest on a monthly basis. This would only be the interest you earned that month, not the full interest that you would receive. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD. A CD calculator is a tool that shows the amount you'll earn on a CD after it matures. In exchange for locking away your funds for a set period of time, banks. CDs are bank deposits that offer an interest rate for a certain period of time. The issuing bank agrees to return your money on a specific date. Learn more. CD values are subject to interest rate risk such that when interest rates rise, the prices of CDs can decrease. If CDs are sold prior to maturity, the investor. Annual percentage yield (APY) This is the effective annual interest rate earned for this CD. A CD's APY depends on the frequency of compounding and the. Navigation skipped. Explore our services. Checking Accounts · Savings Accounts · Credit Cards · Loans · Mortgages · Investing & Retirement. Security Center. Certificate of deposit accounts combine the security of a guaranteed return from a savings account with the higher return associated with an investment. National deposit rates for a 3, 6 and month CD are %, % and %, respectively, according to FDIC's Monthly National Rates and Rate Caps-Monthly. Use the calculator below to explore the impressive gains you can achieve in the current CD market and compare various CD options. Most CDs offer compound interest, which means your interest is added to your account balance at regular intervals. The next interest payment is calculated based.

Is There A Waiting Period For Pet Insurance

Is there a waiting or affiliation period, which means the period of time specified in a pet insurance policy which must pass before some or all of the coverage. For example, we have a day waiting period for illnesses, ligament issues, and accidents. There are no waiting periods for preventive care coverage. Our. Keep in mind: At Lemonade Pet, there is a 14 day waiting period for illnesses from the date your policy goes into effect. What happens if my pet gets. Pet insurers generally don't cover pre-existing conditions. They also may require waiting periods before your pet is eligible for different types of coverages. A pre-existing condition is any injury or illness whose symptoms were showing before the start of your pet's policy, or during a relevant waiting period. When. So they'll often put waiting periods in to weed out anyone who knows they have a problem already and are hoping new insurance will pay for it. The waiting period, which begins the day after you enroll, is a set period of time, of up to 15 days, before your coverage kicks in and you can be paid back. However, there is no waiting period for our preventive care coverage. It starts as soon as your plan takes effect. That means you can enroll in this. Illness and accident coverage have a day waiting period. Pet insurance providers may have different waiting periods, so it's definitely something to look. Is there a waiting or affiliation period, which means the period of time specified in a pet insurance policy which must pass before some or all of the coverage. For example, we have a day waiting period for illnesses, ligament issues, and accidents. There are no waiting periods for preventive care coverage. Our. Keep in mind: At Lemonade Pet, there is a 14 day waiting period for illnesses from the date your policy goes into effect. What happens if my pet gets. Pet insurers generally don't cover pre-existing conditions. They also may require waiting periods before your pet is eligible for different types of coverages. A pre-existing condition is any injury or illness whose symptoms were showing before the start of your pet's policy, or during a relevant waiting period. When. So they'll often put waiting periods in to weed out anyone who knows they have a problem already and are hoping new insurance will pay for it. The waiting period, which begins the day after you enroll, is a set period of time, of up to 15 days, before your coverage kicks in and you can be paid back. However, there is no waiting period for our preventive care coverage. It starts as soon as your plan takes effect. That means you can enroll in this. Illness and accident coverage have a day waiting period. Pet insurance providers may have different waiting periods, so it's definitely something to look.

We have a five-day waiting period for injuries and a day waiting period for illnesses. Unlike many other pet insurance providers, we do not have different. We cover conditions that occur after the waiting period of up to 15 days. Any claims you submit during the waiting period will not be covered. Any accident. These waiting periods typically range from days for accident only coverage and days for illness, but you should confirm with your individual policy. Is there a waiting period before coverage becomes effective? Does my pet need a health exam to get the policy? If my pet has a pre-existing condition or. Currently, Companion Protect is the only provider that has no mandatory waiting period for pet insurance coverage, which means you can file a claim as soon as. (2)(a) A pet insurer may issue policies that impose waiting periods upon effectuation of the policy that do not exceed 30 days for illnesses or orthopedic. Your policy is effective am of the day following the date you enroll your pet, subject to the fifteen (15) day waiting period. This means that if your pet is diagnosed with any of these orthopedic conditions within the first 6 months of the policy, they would not be covered for these. Yes, plans provided by Spot have a 14 day waiting period for coverage. What Medical Records are Needed From My Veterinarian? Other plans may only cover accident and illness. Decide how much coverage you want your pet to have and know whether there is a waiting period before coverage. What is a waiting period? A waiting period is the period of time at the start of your insurance policy before your coverage starts. Waiting periods for pet. Most pet insurance plans provide both accident and illness coverage in about 14 days (although some plans can take as long as 30 days). You can check the. 14 or 15 days is a common waiting period for illnesses, which can run the gamut from minor ear infections and stomach viruses to more serious conditions like. The waiting period is the period of time specified in the policy that must pass before some or all of the coverage begins. The waiting period applies to the pet. If your pet is less than a year old, the medical record should include info from birth through the illness waiting period. We don't need your medical records to. What is a Waiting Period? · Waiting Period for Accident: 0 – 15 days · Waiting Period for Illnesses: 14 – 30 days · Waiting Period for Orthopedic Issues: 14 days –. Most pet insurance companies have a waiting period of between 2 and 14 days for accidents and between 14 and 30 days for illnesses. The waiting period is there. Additionally, pet insurance plans can contain waiting periods before coverage begins for different coverage types. Pets Best offers some of the shortest waiting. Any medical conditions that occur during the waiting period may be counted as a pre-existing condition and excluded from your coverage. This is to discourage. What is the typical waiting period for pet insurance? Waiting periods typically range from two to 14 days for accident coverage and 14–30 days for illness.

How Much Do You Need In Reserves For A Mortgage

Assuming USDA guarantee program it does not normally have a reserve requirement unless it is a lender requirement. The guarantee program is the. The amount of money you should set aside can depend on a number of factors. Learn more about emergency cash reserves by filling out the form below, and let us. How Much Do I Need In Mortgage Reserves? The exact amount you'll need in mortgage reserves varies, depending on your loan program, credit score, DTI ratio. To qualify for a conventional loan, most lenders require you to have a loan-to-value ratio of no more than %. The higher your home's value and the less you. How Can I Get Approved for a Mortgage Without a Source of Income? · You'll need three months of reserves in the bank for loan amounts under $1 million. · You'll. Reserves are just required for the loan to fund, to ensure you have necessary cash to make future payments. Once the loan funds and records and the process is. Required Mortgage Reserves By Loan Program May entail zero to 6 months of reserves, depending on a borrower's credit score, debt-to-income ratio and loan-to-. For example, a borrower with a $1, monthly mortgage payment would need $4, in reserves to qualify for a compensating factor. But if information from the. Typically, you don´t need reserves when purchasing a primary residence. Although if your credit score is low or you are buying a second home, investment. Assuming USDA guarantee program it does not normally have a reserve requirement unless it is a lender requirement. The guarantee program is the. The amount of money you should set aside can depend on a number of factors. Learn more about emergency cash reserves by filling out the form below, and let us. How Much Do I Need In Mortgage Reserves? The exact amount you'll need in mortgage reserves varies, depending on your loan program, credit score, DTI ratio. To qualify for a conventional loan, most lenders require you to have a loan-to-value ratio of no more than %. The higher your home's value and the less you. How Can I Get Approved for a Mortgage Without a Source of Income? · You'll need three months of reserves in the bank for loan amounts under $1 million. · You'll. Reserves are just required for the loan to fund, to ensure you have necessary cash to make future payments. Once the loan funds and records and the process is. Required Mortgage Reserves By Loan Program May entail zero to 6 months of reserves, depending on a borrower's credit score, debt-to-income ratio and loan-to-. For example, a borrower with a $1, monthly mortgage payment would need $4, in reserves to qualify for a compensating factor. But if information from the. Typically, you don´t need reserves when purchasing a primary residence. Although if your credit score is low or you are buying a second home, investment.

The bank's required minimum reserve is $50 million. Where Do Banks Keep Their Reserves? Some of it is stashed in a vault at the bank. Effective April 2, , the 12 percent required reserve ratio against net transaction deposits above the low reserve tranche level was reduced to 10 percent. We only require 3 months of reserves! Loan amount. The maximum they can borrow for a DSCR loan depends upon the lender, but many financial institutions offer. My quick and simple answer is 6 months of PITI (Principal, Interest, Taxes, and Insurance) or $10, in reserves for each rental property. Which ever is. 2% of the aggregate UPB if the borrower has one to four financed properties, · 4% of the aggregate UPB if the borrower has five to six financed properties, or · 6. What is your desired location? Your location will be used to find available mortgages and calculate taxes. Do this later. Dismiss. First things first: How much in cash reserves do you need for business use? Business banking experts usually advise business owners to save enough cash to cover. Lenders typically require you to have 2 months of mortgage payments on hand in case of emergency. Related questions. Will I have a point of contact at Better. Having money saved or in investments that you can easily convert to cash, known as cash reserves, proves that you can manage your finances and have funds, in. What are mortgage reserves and how do they work? The specific calculation is the total amount of liquid assets remaining after the loan transaction closes divided by your monthly mortgage payment including. Let's say that your total monthly housing costs will be $1, If the lender says you need two months reserves you must have $2, If your monthly housing. Let's say that your total monthly housing costs will be $1, If the lender says you need two months reserves you must have $2, If your monthly housing. How much should you plan for your contingency reserve budget? The contingency reserve budget should reflect a portion of the hard or total costs for a. Step 1: How much can we afford? The down payment is the money you put towards the total cost to buy, build or complete major renovations. It can often. For example, a borrower with a $1, monthly mortgage payment would need $4, in reserves to qualify for a compensating factor. But if information from the. Factors like your credit score, loan type, debt-to-income-ratio and loan-to-value ratio will determine the exact amount of cash reserves you may need. Generally. When buying a second home, you'll likely need extra money in reserve that could cover your mortgage payments in case you have a temporary loss of income. How much of a deposit you have available - most lenders will require at least a 15% deposit although some can accept 10% or even 5%. Your age and the risk. For HUD multifamily loans, the minimum amount of replacement reserves required varies based on loan type. For example, HUD (d)(4) loans require a minimum.

Real Stock Apps

Top 21 Stock trading App you will find in ; Fidelity, $0 (Stocks & ETFs), Extensive research tools, Fractional shares, Strong customer support ; Charles. Keep track of your stocks and financial instruments straight from your desktop — all in real time. Stock Desktop Widget Pro is an optional in-app. The most comprehensive stock app in the mobile world. Brings you free streaming live quotes, pre-market/after-hour quotes, portfolio monitoring. Paper trade on apps like Think or Swim or Power Etrade for at least a year. I prefer Think or Swim since the market data is not delayed. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Join NAGA, the all-in-one trading platform offering over assets, including Real Stocks, Currency CFDs, Indices, Commodities, ETFs, and more. The best investment apps can also let you quickly trade stocks, follow your account in real time, help you learn about the markets and more. Best Investment Apps · View All · Mortgages. Mortgages. Homeowner Guide · First-Time Real estate investing means investing in properties. There are two. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. Top 21 Stock trading App you will find in ; Fidelity, $0 (Stocks & ETFs), Extensive research tools, Fractional shares, Strong customer support ; Charles. Keep track of your stocks and financial instruments straight from your desktop — all in real time. Stock Desktop Widget Pro is an optional in-app. The most comprehensive stock app in the mobile world. Brings you free streaming live quotes, pre-market/after-hour quotes, portfolio monitoring. Paper trade on apps like Think or Swim or Power Etrade for at least a year. I prefer Think or Swim since the market data is not delayed. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Join NAGA, the all-in-one trading platform offering over assets, including Real Stocks, Currency CFDs, Indices, Commodities, ETFs, and more. The best investment apps can also let you quickly trade stocks, follow your account in real time, help you learn about the markets and more. Best Investment Apps · View All · Mortgages. Mortgages. Homeowner Guide · First-Time Real estate investing means investing in properties. There are two. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees.

Build real wealth. Didn't grow up learning about money? Me Invest in your financial education with Briefs Academy, my financial education platform. Jargon-free courses, paired with the web's best virtual stock market. Practice how to buy stocks under real market conditions. Our program lets people buy. Invest in Stocks, Bonds, Treasuries, Crypto, Options, ETFs, alternative assets, and music royalties with AI-powered fundamental data and custom analysis. Invest in stocks and ETFs without commission when buying and selling shares. Instant online stock trading. Awarded best online trading app 3 years in a row. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. What to Look for in the Best Stock Market Apps · Acorns works in a similar way, but it extends even more support by making your investment automatic. · Yahoo! Discover top real estate investment opportunities with Landa, the premier platform for real estate investing. Elevate your real estate portfolio. The Appreciate app is pretty amazing. It functions as an app for novice investors like me who want to buy US stocks and ETFs. So really practical. A one-stop trading app that packs many features of thinkorswim desktop into the palm of your hand. Stay connected to the market on the go with this secure. Build your portfolio and react to the markets in real time. Compete against your friends or coworkers to earn your spot at the top of the leaderboards. What are the best real stock trading apps that can automatically buy and sell when stocks rises or drops a certain percentage? There are many excellent trading apps available, but here are three that stand out for their wide range of features and competitive pricing. Join the competition now and prove your investing prowess! The Stock Market Game. Connect students to the global economy with virtual investing and real-world. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. See the best investment apps by category as picked by the experts at Moneywise. From beginner investors to real estate and crypto investing, here's the best. This ensures your investment remains aligned with the portfolio in real time. Unlike other trading apps, dub believes the future of trading revolves. Interactive Brokers has been the to-go app for a variety of traders for some time now. It features robust charting tools, numerous screeners, portfolio analysis. Jargon-free courses, paired with the web's best virtual stock market. Practice how to buy stocks under real market conditions. Our program lets people buy. In this review, we looked at some stock apps that accept PayPal as a deposit method. While these brokers are good options for any trader, this is not an.

How Do I Sell My Own Property

Help the tenant find a new residence, if needed. If you own other investment properties, alert the tenant to any appropriate openings. If you are not an. If there is any money leftover, it goes directly to you. This is the case if you have enough equity saved in your home. But in cases where you want to sell the. In general, real estate agents don't earn a commission when selling their own house since this would involve paying yourself. However, this is still a. Sell or rent your own property. With over 20, properties successfully listed, you can confidently sell your home privately getting the results you want. See. Browse exclusive homes for sale by owner or sell your home FSBO. legrandrozetki.ru helps you sell your home fast and save money. Deciding how to sell your house · Method of sale · Marketing and advertising · Decide on a listing price · Prepare the property · Knowing the best deal · Signing the. One of the most important aspects of selling is finding a great listing agent. · Strategize with your agent about the best time to sell your house. · View the. Learn how to sell your home using agent pairing technology that connects you with agents in real-time. An inspection flushes out any defects your home may have and gives buyers to have the right to cancel the contract based on these problems. They can also. Help the tenant find a new residence, if needed. If you own other investment properties, alert the tenant to any appropriate openings. If you are not an. If there is any money leftover, it goes directly to you. This is the case if you have enough equity saved in your home. But in cases where you want to sell the. In general, real estate agents don't earn a commission when selling their own house since this would involve paying yourself. However, this is still a. Sell or rent your own property. With over 20, properties successfully listed, you can confidently sell your home privately getting the results you want. See. Browse exclusive homes for sale by owner or sell your home FSBO. legrandrozetki.ru helps you sell your home fast and save money. Deciding how to sell your house · Method of sale · Marketing and advertising · Decide on a listing price · Prepare the property · Knowing the best deal · Signing the. One of the most important aspects of selling is finding a great listing agent. · Strategize with your agent about the best time to sell your house. · View the. Learn how to sell your home using agent pairing technology that connects you with agents in real-time. An inspection flushes out any defects your home may have and gives buyers to have the right to cancel the contract based on these problems. They can also.

Affidavit of title. A notarized document that states you own the home, that there are no liens on the property, that you aren't simultaneously selling the home. You certainly can sell a property yourself without involving a realtor. In fact state licensing which allows one to sell real estate owned by. Ownership is not a requirement for a seller to sell a property interest. The seller just needs to (1) have a contractual interest or an option to purchase the. If between owner and finding agent, yes. No real estate agent or broker can do this. If my reply is acceptable please reply “yes” or “acceptable” If you have a. Learn how to sell your home using agent pairing technology that connects you with agents in real-time. 82% of members have their own listings on their website, 70% have information about buying and selling, and 65% have a link to their firm's website. 77% of. 1. Decide if you should sell · 2. Figure out your finances · 3. Decide if you should rent a house next, rather than buy · 4. Choose an estate agent to sell your. Advertise online. Put an ad for your home on a website like Craigslist. Take out classified ads in your local newspaper and ask if they'll be available on a. Capital gains taxes on real estate and property can be reduced when you sell Do I Have to Report the Sale of My Home to the IRS? It is possible that you. Lenders generally require a prospective buyer to pay a down payment from their own funds, (which might include earnest money paid at the time the Contract is. You can also market the home on your own (i.e. handle all advertising, open houses, and private displays on your own), but use the attorney to process the. You and the buyer's agent (or the buyer, if they don't have a real estate agent) will negotiate the final sale price. You'll also negotiate other issues. You can do this on your own by researching similar local listings, market trends and recent sales near you. You'll want to find a sweet spot that isn't. Negotiate the closing date. You found a buyer for your current home—whew! · Set up a rent-back agreement. · Stay with family or friends. · Pay for temporary. There are plenty of other ways to sell your house, too, besides the open market. Cash buying companies have become more common in recent years. Reliable ones. Pick a selling strategy. Hire an experienced real estate agent. Clean everything. Depersonalize your home. Let the light in. Remove excess furniture and clutter. You can sell your own home in any state without being (or using) a licensed real estate agent. It's not a good idea, but you can do it. If I had. You have significant equity in the home · You have cash for down payment and closing costs · The market is good for sellers. How to Sell Your House Fast and Get the Most Money: A real estate auction is the fastest way to get the most money for your home. A professional real estate. Agent Fees: Sellers typically pay % of the home sale price, split between their agent and the buyer's agent. · Closing Costs: Closing costs can be negotiated.

Start A Hedge Fund

Depending on the amount of assets in the hedge funds advised by a manager, some hedge fund managers may not be required to register or to file public reports. The term hedge fund is something of a misnomer: While some funds may employ strategies that are “hedged” in the traditional sense to mitigate or reduce risk. How to legally start a hedge fund · 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. You can start providing investment advisory services without registering with anyone. You may need series 65 or 66 license, but there may be exemption if you. Akshat mentioned he is using his own funds to start what he calls a "hedge fund." This deviation from the norm has raised some eyebrows. To incorporate a hedge fund, the promoter needs to set up the hedge fund entity. This can be either a mutual fund or an exempt company with variable capital. To save money, you can start from your home at first, use a “hedge fund hotel,” or share space with other managers. This practical guide outlines the allocation process for fledgling funds, and demonstrates how allocators can avoid pitfalls in their investments. In order to start a hedge fund in the United States, two business entities typically need to be formed. The first entity is created for the hedge fund itself. Depending on the amount of assets in the hedge funds advised by a manager, some hedge fund managers may not be required to register or to file public reports. The term hedge fund is something of a misnomer: While some funds may employ strategies that are “hedged” in the traditional sense to mitigate or reduce risk. How to legally start a hedge fund · 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. You can start providing investment advisory services without registering with anyone. You may need series 65 or 66 license, but there may be exemption if you. Akshat mentioned he is using his own funds to start what he calls a "hedge fund." This deviation from the norm has raised some eyebrows. To incorporate a hedge fund, the promoter needs to set up the hedge fund entity. This can be either a mutual fund or an exempt company with variable capital. To save money, you can start from your home at first, use a “hedge fund hotel,” or share space with other managers. This practical guide outlines the allocation process for fledgling funds, and demonstrates how allocators can avoid pitfalls in their investments. In order to start a hedge fund in the United States, two business entities typically need to be formed. The first entity is created for the hedge fund itself.

This book provides a concise guide through the process of structuring, launching and raising capital for domestic and offshore hedge funds and other private. To start a U.S. hedge fund, you generally need to form two business entities: the hedge fund, and its investment manager. The hedge fund is typically set up as. Getting Started in Hedge Funds: From Launching a Hedge Fund to New Regulation, the Use of Leverage, and Top Manager Profiles [Strachman, Daniel A.] on. Research the fund. Get a copy of the private prospectus and marketing material, to understand the risks as well as potential returns. · Learn about the fund's. This Hedge Fund Start-Up Guide is designed to help fill the gap. Drawing on advice from both investors and managers, it provides practical advice for all. We'll provide you with a comprehensive guide to starting an online hedge fund. From understanding hedge funds to building your investment strategy. A practical, definitive "how-to" guide, designed to help managers design and launch their own funds, and to help investors select and diligence new funds. In general, the process to start a hedge fund includes: · refining the investment program and and compiling investment results · determining the appropriate. To start a hedge fund, you'll need to create and register a fund and start an investment company to be the fund's general partner. This process commonly begins with a meeting to set out a road map to fund launch. The following is a distillation of those meetings, covering some of the. Generally, a minimum of $, is required to launch a hedge fund, although some funds may require a much larger amount. Additionally, you may need to prove. These low-tax or tax-free jurisdictions do not impose corporate-level taxes on offshore hedge funds. The investors are generally taxed in their country of. Here is a step-by-step guide to designing and setting up a hedge fund based on various external expert opinions if you are an experienced advisor or portfolio. Launching a hedge fund is a major undertaking that requires a systematic approach and experienced partners in a variety of industries and areas of expertise. In this extensive guide, we explore the intricacies of starting a hedge fund in the US, with a focus on legal and regulatory compliance, fund formation, and. I'll show you how, with the right plan, partnerships, and technology, you can start your firm on the right path and set up for long-term success. The procedure to establish a hedge fund in the United States follows a well-defined path because these alternative investment products have been in place for. Step 1. Forming your Fund Step 2. Setting up your bank and brokerage accounts Step 3. Beginning trading. Creating a Hedge Fund Entity · Step 1 Hire a law firm. A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment.

How Accurate Is Your Credit Score On Experian

Much like Credit Karma, the accuracy of Experian scores largely depends on the data it collects. Since Experian is a credit bureau itself, it has direct access. A credit report is a summary of your personal credit history. Your credit The three nationwide credit bureaus — Equifax, Experian, and TransUnion — have a. While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus. The credit scores that you receive from each. The only alternative for the user is to contact Experian directly to correct any information that may be incorrect on their Information veri ied as accurate. All three of the major credit bureaus use their own internal algorithms when determining a person's score. Even if the starting information is identical, the. This is because individual consumer reporting agencies, credit scoring companies, lenders and creditors may use slightly different formulas to calculate your. Experian uses data provided by information furnishers to create credit reports and scores. Learn what the accuracy depends on. The Experian Free Credit Score runs from It's based on information in your Experian Credit Report – like how often you apply for credit, how much you owe. If you are referring to Experian Boost, then yes it does reflect your updated credit score after it finds your utility payments in your checking. Much like Credit Karma, the accuracy of Experian scores largely depends on the data it collects. Since Experian is a credit bureau itself, it has direct access. A credit report is a summary of your personal credit history. Your credit The three nationwide credit bureaus — Equifax, Experian, and TransUnion — have a. While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus. The credit scores that you receive from each. The only alternative for the user is to contact Experian directly to correct any information that may be incorrect on their Information veri ied as accurate. All three of the major credit bureaus use their own internal algorithms when determining a person's score. Even if the starting information is identical, the. This is because individual consumer reporting agencies, credit scoring companies, lenders and creditors may use slightly different formulas to calculate your. Experian uses data provided by information furnishers to create credit reports and scores. Learn what the accuracy depends on. The Experian Free Credit Score runs from It's based on information in your Experian Credit Report – like how often you apply for credit, how much you owe. If you are referring to Experian Boost, then yes it does reflect your updated credit score after it finds your utility payments in your checking.

FICO ® Scores are the only credit score used by 90% of top lenders. Other credit scores can vary as much as points. Knowing your FICO Scores helps you. FICO provides a single-number credit score, while major credit bureaus like Equifax, Experian, and TransUnion (not covered in this article) offer a more. A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. Using MyCredit Guide won't impact your score, no matter how often you check it. For a score with a range between and , a credit score of or above is generally considered good. A score of or above on the same range is. VantageScore uses the same information to calculate your credit scores that FICO does, but it weighs the information differently. The result is that you can. And don't worry– checking your own credit will not hurt your score. Get your Experian credit report and FICO® Score* with a free Experian membership—no credit card needed correct credit data (according to other. And don't worry– checking your own credit will not hurt your score. Checking your business credit score has no impact on your personal credit score, and vice versa. Business credit scores reflect your company's image to. FICO claims its scores are used by 90% of top lenders. VantageScore: Founded in by Equifax, Experian and TransUnion. The company uses several different. Get your Experian credit report and FICO® Score* with a free Experian membership—no credit card needed! Learn how to instantly raise your FICO Score with. As long as the information reported by creditors is correct, you can trust Experian's credit report. Customers can also get peace of mind from the reliability. The scoring seems counterintuitive for consumers accustomed to the FICO system. In Experian's system a score of means a 10% chance that at least one account. You can access your free Experian credit report at any time by signing up for a free Experian account. You can request annual credit reports for free from each. FICO® Scores are updated weekly refreshed upon login. Experian credit reports are updated monthly, or any time a financial institution reports a change to your. Checking your business credit score has no impact on your personal credit score, and vice versa. Business credit scores reflect your company's image to. Typically, people with scores in the good or excellent range have more access to better financial products. The two most prominent credit scores are from FICO. Is Your Credit Report Accurate? What If The Information is Right But Not That's in addition to the one free Equifax report (plus your Experian and TransUnion. Because legrandrozetki.ru is a part of Experian, know that your free FICO® Score will be delivered securely utilizing, Secure Socket Layer (SSL) encryption.

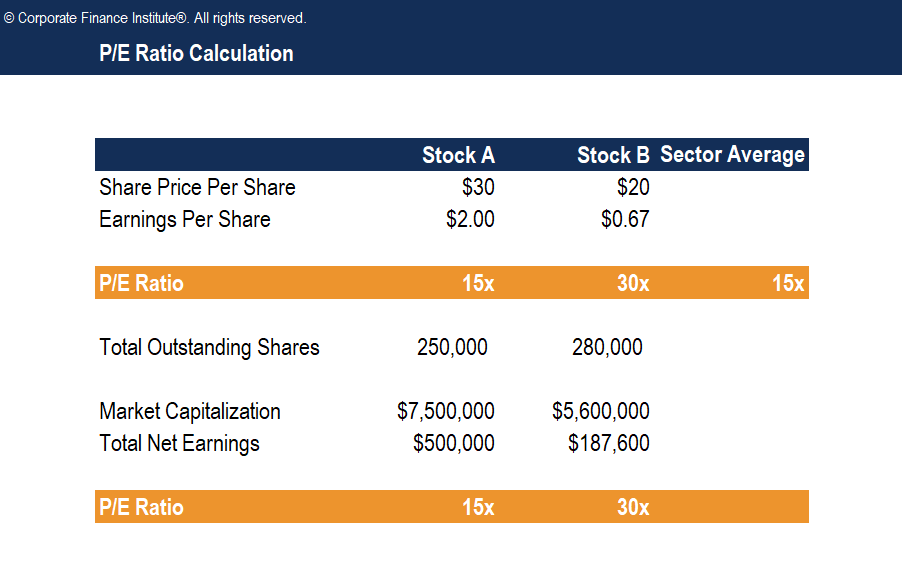

Whats A Good Pe Ratio

A higher PE suggests high expectations for future growth, perhaps because the company is small or is an a rapidly expanding market. For others, a low PE is. What is a Good P/E Ratio? There is no “good” P/E ratio, and the current P/E ratio of a company doesn't provide much information alone. In the examples above. Average P/E Ratios generally range from 20 to While the lower a P/E Ratio is, the better, any P/E Ratio below this average is generally considered. However, a P/E ratio below 15 is considered cheap and stocks with a P/E ratio above 18 are considered expensive. Which PE ratio is good high or low? Price-to-Earnings Ratio (PE Ratio) · Formula: how to calculate the PE ratio · Examples · Different types of PE ratios · What is a good PE ratio? · The PEG Ratio . A question that riddles investors when using P/E ratio to decide where to invest is what can be considered as a good or safe ratio. However, it is essential to. Historically, a P/E ratio between 20 and 25 is considered good. “But in reality, it also depends on the industry,” Nana says. You can get a clearer picture by. Thus, it's fair to pay a P/E ratio of about 15 for a moderate-growth stock with healthy free cash flow that just keeps up with GDP growth (changes in inflation. Generally, a P/E ratio between 10 and 20 is considered to be a good range for a company's shares. However, it is important to remember that the. A higher PE suggests high expectations for future growth, perhaps because the company is small or is an a rapidly expanding market. For others, a low PE is. What is a Good P/E Ratio? There is no “good” P/E ratio, and the current P/E ratio of a company doesn't provide much information alone. In the examples above. Average P/E Ratios generally range from 20 to While the lower a P/E Ratio is, the better, any P/E Ratio below this average is generally considered. However, a P/E ratio below 15 is considered cheap and stocks with a P/E ratio above 18 are considered expensive. Which PE ratio is good high or low? Price-to-Earnings Ratio (PE Ratio) · Formula: how to calculate the PE ratio · Examples · Different types of PE ratios · What is a good PE ratio? · The PEG Ratio . A question that riddles investors when using P/E ratio to decide where to invest is what can be considered as a good or safe ratio. However, it is essential to. Historically, a P/E ratio between 20 and 25 is considered good. “But in reality, it also depends on the industry,” Nana says. You can get a clearer picture by. Thus, it's fair to pay a P/E ratio of about 15 for a moderate-growth stock with healthy free cash flow that just keeps up with GDP growth (changes in inflation. Generally, a P/E ratio between 10 and 20 is considered to be a good range for a company's shares. However, it is important to remember that the.

What is a good Price-to-Earnings ratio? Unfortunately, there is no straightforward answer to what P/E ratio is considered good, but there are ways to help you. PE Ratio by Sector (US) ; Auto & Truck, 34, % ; Auto Parts, 39, % ; Bank (Money Center), 15, % ; Banks (Regional), , %. The price-to-earnings ratio, or P/E ratio, is one way investors can determine if they're getting a good deal on a stock. Here's how it works. Generally, the lower the P/E ratio, the more favourable the investment, as it suggests the stock is undervalued compared to its earnings. Is it good if PE ratio. Average PE of Nifty in the last 20 years was around * So PEs below 20 may provide good investment opportunities; lower the PE below 20, more attractive the. Analyzing a company's P/E ratio is vital for making an informed investment decision. Generally, a stock with a higher P/E compared to its peer group is. Historically, a P/E ratio between 20 and 25 is considered good. “But in reality, it also depends on the industry,” Nana says. You can get a clearer picture by. A better way to tell if a stock has a good P/E Ratio is to compare it against industry averages and growth expectations. Average P/E Ratios generally range from. A low but positive P/E ratio stands for a company that is generating high earnings compared to its current valuation and might be undervalued. A company with a. The earnings per share (the "E" part of the equation) has remained at $5, but because of investors' optimism, the average P/E ratio rises from 16 to The average market P/E ratio is times earnings. Estimated earnings can be used to calculate the projected P/E ratio. Companies that are losing money do. The key word for answering the question, “What's a good P/E ratio?” is it's all relative. A price-earnings ratio in isolation means little. It must be. What's a good P/CF ratio? It varies from industry to industry, but some analysts use 10 as the cutoff between undervalued (below 10) and overvalued (above. It means they are undervalued because their stock prices trade lower relative to their fundamentals. This mispricing will be a great bargain and will prompt. Price Earnings (P/E) ratio is one of the most popular ways of valuing a stock. The thumb rule is that a low P/E ratio is a sign of undervaluation while a. What Is a Good P/E Ratio? Though very valuable as an analytical tool, the P/E ratio is a subjective data point. P/E ratios cannot be labeled as good or bad on. At a basic level, a price earnings, (P/E) ratio is a way to measure how expensive a company's shares are. However, what constitutes a good P/E ratio can vary depending on several factors such as industry norms and investor expectations for future earnings growth. In. A question that riddles investors when using P/E ratio to decide where to invest is what can be considered as a good or safe ratio. However, it is essential to.